Trustee Reporting Obligations Under ATF Rules

Trustee Reporting Obligations Under ATF Rules

If you manage an NFA trust, staying compliant with ATF rules is non-negotiable. Here's what you need to know:

- NFA Items: Includes machine guns, suppressors, short-barreled rifles/shotguns, and more. All require ATF registration and background checks.

- Trustee Responsibilities: Handle forms like ATF Form 5320.23, notify local law enforcement (CLEO), and maintain accurate records.

- ATF Rule 41F: Effective since July 13, 2016, requires all "responsible persons" in the trust to undergo background checks and submit fingerprints/photos.

- Updating the Trust: Report changes like adding trustees during active applications to the ATF. Amend trust documents properly and keep records updated.

- Record-Keeping: Maintain detailed logs of all transactions, tax stamps, and trust amendments to avoid penalties or audits.

Noncompliance can lead to fines up to $250,000 per firearm and federal charges. Use tools like TrustNFA for easier trust management and lifetime free document updates.

Quick Tip: Stay organized, follow reporting steps, and consult legal experts to ensure compliance.

Gun Trust Series Part 2 - 41F

Required Reports for NFA Trustees

If you're an NFA trustee, staying on top of your reporting obligations is essential. This involves understanding your responsibilities as a trustee, knowing which forms to file, and following the CLEO notification process. The ATF has outlined clear steps to help trustees comply with federal laws.

Responsible Person Definition and Duties

According to ATF Rule 41F, a "responsible person" is someone authorized to oversee the trust, particularly when it involves NFA-regulated items. This typically includes trustees who handle tasks like acquiring, transferring, or managing these items. As a responsible person, you’re required to pass the same background check as individual applicants to confirm your federal eligibility. This role comes with legal accountability, which means ensuring all NFA regulations are followed, maintaining accurate records, and adhering to proper transfer procedures.

Form 5320.23 Submission Requirements

A key part of your reporting duties is completing ATF Form 5320.23, also called the Responsible Person Questionnaire. Every responsible person tied to the trust must fill out this form when applying for NFA items through Forms 1, 4, or 5. The questionnaire gathers detailed information, including your role within the trust, your home address, and your citizenship status, along with other background details needed to confirm your eligibility. Additionally, you’ll need to provide two fingerprint cards (Form FD-258) and a 2x2-inch photograph. Accuracy is critical here - any mistakes could delay or even derail your application. Once completed, submit two copies of Form 5320.23: one to the ATF and one to your local CLEO. This brings us to the CLEO notification process, which finalizes your reporting requirements.

CLEO Notification Process

The CLEO notification system replaced the older certification process, making it easier for trustees to meet their reporting obligations. When applying for an NFA item, each responsible person must notify their local CLEO by sending copies of the necessary forms. Your CLEO could be your local Chief of Police, Sheriff, Head of State Police, or another designated law enforcement official, such as a district attorney or prosecutor. For gun trusts, this means providing copies of Form 4 and Form 5320.23 (commonly known as Form 23). It's a good idea to use tracked mail to document your CLEO notification. Make sure to send this notification before submitting your ATF application to ensure local law enforcement is informed about any pending NFA-related activities.

Reporting Changes to NFA Trusts

Making changes to your NFA trust isn’t overly complicated, but timing is everything when it comes to meeting ATF reporting requirements. Whether you’re adding trustees or updating existing details, your compliance hinges on the status of your application. Below, we break down how to update trustee information and amend trust documents properly.

Updating Trustee Information

The process for updating trustee information depends on whether you have an active application with the ATF. If there’s no pending tax stamp application, you’re free to adjust your trust without notifying the ATF. However, if an application is in progress, you must report any changes immediately.

If you need to add a responsible person during an active application, you’ll need to contact the assigned examiner and provide them with the amendment detailing the changes. This step ensures the ATF has up-to-date information about everyone authorized to manage the NFA items in your trust.

For those without an active application, adding trustees is a bit more straightforward. However, you must already have an approved NFA gun trust on file with the ATF before making these additions. Keep in mind, you cannot add trustees while an application is pending, so plan any updates carefully.

When adding trustees, you’ll need to prepare the following documents:

- A photocopy of your completed and notarized official gun trust (do not send the original).

- A notarized amendment identifying the trust and the new trustee details.

- An acknowledgment document signed by the new trustee.

Both the amendment and acknowledgment require signatures and notarization. Once these changes are made, include a copy of the amendment with your trust when submitting future tax stamp applications.

For ongoing updates, the Change of Co-Trustees amendment is your go-to tool. Simply print and complete the amendment with the necessary details, then attach it to the back of your notarized trust. This amendment allows you to add or remove co-trustees as needed, whether temporarily or permanently. Be sure to destroy any previous versions of the amendment to prevent confusion.

Amending Trust Documents

After updating trustee information, it’s essential to formalize these changes through proper trust amendments. These legal documents are used to adjust key details in your NFA trust, such as adding or removing responsible parties. The process varies by state, but notarization is typically required to make amendments legally valid.

Amendments replace the relevant sections of your original trust document. For instance, if you need to update your address, you’ll complete a Change of Address amendment and file ATF Form 20 to notify the ATF of the permanent address change. When filling out Form 20, select the option for a permanent move.

There are two main types of amendments:

- Standard Amendment: Makes specific changes to certain sections of your trust.

- Amendment and Restatement: Completely replaces the original trust agreement while consolidating all provisions, including trustee appointments and beneficiary designations, into one updated document.

When drafting amendments, start by reviewing your current trust document to understand the procedures for making changes. Then, create a notarized amendment that identifies the trust, outlines the changes, and includes signatures from the grantor and, in some cases, the trustees.

Once the amendments are finalized, notify all trustees and beneficiaries of the updates. Keep organized records of all trust-related documents and provide copies to the responsible parties. Store these documents securely to ensure easy access when needed.

For trusts holding NFA items, you might need to file amendments with the appropriate government agency. Regularly reviewing your trust ensures it stays aligned with any changes in your circumstances, laws, or goals.

If this process feels overwhelming, services like TrustNFA can simplify it. They offer attorney-drafted trust documents with lifetime free revisions, so you can make updates without worrying about compliance or extra legal fees. This ensures your trust stays current with both your needs and ATF regulations.

sbb-itb-6d07923

Record-Keeping Requirements for Trustees

Keeping accurate records isn’t just a good habit - it’s a legal necessity. Trustees are required to maintain detailed documentation for all transactions involving NFA firearms. This includes copies of ATF forms, approvals, correspondence, and records of any transfers or modifications to the firearms. These records are your safeguard, ensuring your trust complies with federal regulations in case of an ATF audit or investigation.

Disorganized records can turn a routine audit into a compliance nightmare. On the other hand, well-maintained documentation shows your commitment to following the rules. Think of your records as your safety net when questions arise about your NFA items. Below are some essential practices for keeping your records in order.

Keeping ATF Forms and Tax Stamps

Your original tax stamps are among the most important documents you’ll handle. Store these safely at home in a secure place like a safe or filing cabinet. When carrying NFA items, don’t take the originals with you. Instead, keep certified copies with the firearms and leave the originals securely stored.

Approved Form 20s come with specific retention rules depending on their purpose. For permanent changes, such as a change of address, you’ll need to keep these forms for as long as you own the items. Temporary Form 20s, however, can be discarded once their expiration dates pass. This distinction is crucial because permanent moves create a lasting record requirement, while temporary authorizations are time-limited.

Your trust document also needs ongoing attention. Keep it updated with any changes, such as new addresses, co-trustees, beneficiaries, or updates to trust property. Each amendment should be added to your main trust document and organized in chronological order.

If you sell an item, especially in a private sale, keep all related documentation. These records prove the item has legally left your possession and protect you from future liability.

For Federal Firearms License (FFL) holders, managing NFA items requires even more organization. Treat the NFA side of your business as a separate entity, maintaining distinct files, paperwork, and acquisition and disposition logs. When handling Form 3s, organize them by supplier and then by the date ATF approved the transfer. Keep these forms for the life of your business. Always verify Form 3 details against supplier invoices and the actual items received, and address any discrepancies immediately.

Inventory and Transfer Logs

Accurate transaction records are the backbone of NFA compliance. Trustees must document every transaction involving the trust’s firearms - not just by filing forms but by creating a tracking system that records every movement, modification, or change.

Interstate transportation adds another layer of documentation. Moving NFA items across state lines typically requires prior approval from the ATF via Form 5320.20. When planning such transport, ensure you have copies of the trust instrument, tax stamps, and any relevant permits ready for inspection.

Transfer logs should detail every movement of NFA items in and out of the trust. This includes completing all necessary paperwork and documenting the date, parties involved, authorization forms, and any special conditions or restrictions. Changes in trustees or beneficiaries may also need to be reported to the ATF, so it’s essential to track personnel changes alongside item movements.

Your trust should have a clear, defined procedure for record-keeping. This includes specifying who is responsible for maintaining records, where they’re stored, how long they’re kept, and who has access to them. Copies of ATF tax stamps and any state-required permits should also be included in your system.

Digital tools are increasingly valuable for managing these complex requirements. Compliance software can provide an easily auditable trail for every transaction, reducing the risk of errors being interpreted as intentional violations. These tools often include automated FFL audit logs, streamlined e-Bound Book features, and integrated Form 4473 processing to simplify compliance tasks. User permissions and detailed transaction histories further enhance accountability and demonstrate strong internal controls.

Services like TrustNFA make documentation easier by offering attorney-drafted trust documents with lifetime free revisions. This ensures your trust paperwork stays up to date and compliant, giving you a solid foundation for managing your records. With professionally maintained trust documents, you can focus on tracking transactions and transfers without worrying about whether your paperwork is valid.

Tools and Services for Easier Compliance

Managing ATF reporting requirements can feel overwhelming, but modern tools and services are designed to take the weight off your shoulders. By automating document management, tracking deadlines, and securely storing records, these solutions make staying compliant far less of a hassle. They integrate seamlessly with the trust documentation and record-keeping practices we discussed earlier, ensuring every piece of the puzzle fits together smoothly.

Instead of juggling deadlines and forms manually, you can rely on systems built to keep you on track.

Using TrustNFA for Trust Documentation

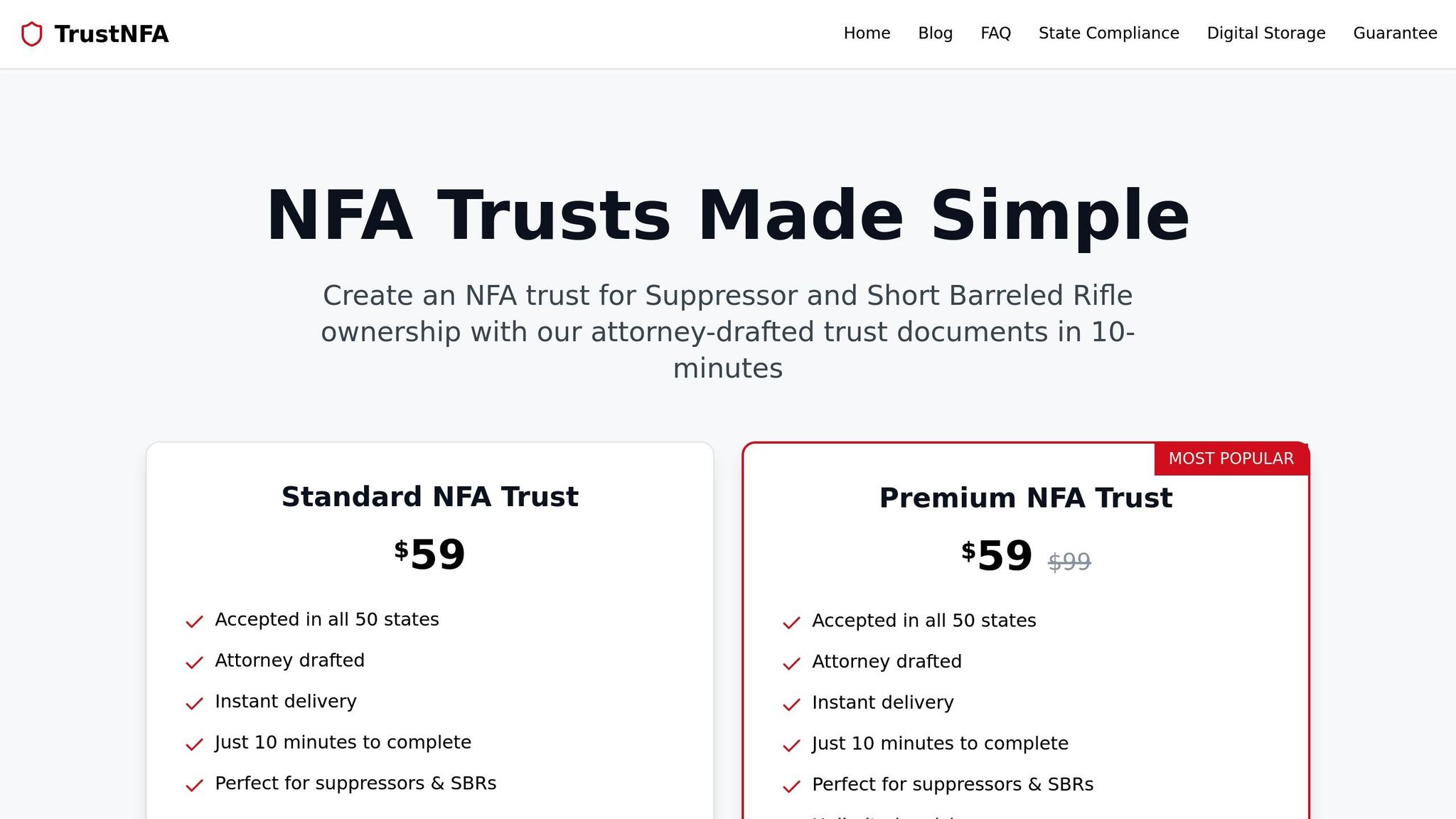

TrustNFA simplifies the process of creating and managing trust documents that meet ATF standards. For just $59, you get attorney-drafted NFA trust documents with a quick 10-minute setup. These documents are legally valid and accepted in all 50 states, making them a practical solution for trustees everywhere.

One of the biggest challenges trustees face is keeping their trust documents up to date. TrustNFA solves this by offering lifetime free revisions, so you can make updates whenever your circumstances change - without worrying about extra fees. Plus, secure digital storage ensures your documents are always accessible, protecting you from the risk of losing physical copies.

The service also provides guidance for completing ATF Form 1 and Form 4, which are essential for manufacturing or purchasing NFA items. With professional assistance, you can reduce the chances of delays or rejections during the submission process. Since all TrustNFA documents are attorney-drafted, they meet the latest legal and ATF standards, giving you confidence that your paperwork will hold up during audits or transfers.

Automated Tracking and Notifications

While TrustNFA handles documentation, automation tools take care of ongoing compliance. These tools monitor deadlines, send reminders, and securely back up your digital records. They can even integrate with your existing processes, eliminating the need for duplicate data entry.

Conclusion: Staying Compliant as an NFA Trustee

Serving as an NFA trustee comes with serious responsibilities, especially when it comes to following ATF regulations. Failure to comply can lead to hefty penalties, including fines of up to $250,000 per firearm and potential criminal charges. For individuals and entities setting up a firearm trust, understanding and adhering to these regulations is non-negotiable.

Staying compliant means keeping meticulous records, staying informed about current regulations, and seeking professional advice when needed. Regularly auditing your firearms and associated paperwork is a critical step for anyone involved with the trust.

Additionally, keeping up with regulatory changes is essential. The rules surrounding firearms can shift, making it important to consult legal experts in firearms law and stay tuned to updates from the ATF. Scheduling an annual review of your trust with an attorney can help ensure you remain compliant year after year.

FAQs

What happens if an NFA trustee fails to comply with ATF regulations?

Failing to follow ATF regulations as an NFA trustee can bring severe penalties. These can include fines reaching $250,000, up to 10 years in prison, and the loss of any firearms tied to the violation. Beyond that, noncompliance may lead to the revocation of firearm ownership rights down the road.

Both the trustee and the grantor of the trust could face criminal charges, making strict adherence to ATF rules absolutely critical. Staying within the law not only shields you from legal trouble but also keeps the trust valid for owning and managing regulated firearms.

What steps should I take to properly maintain and update my NFA trust records to stay compliant with ATF rules?

To comply with ATF regulations, it's crucial to keep your NFA trust records both accurate and up to date. Start by securely storing copies of all relevant ATF forms, such as Form 4, for every NFA item held under the trust. Make it a habit to regularly review your trust documents to account for any updates, like changes to responsible persons or ownership details.

It's also important to maintain a thorough record of any transfers or dispositions involving your NFA items. Staying organized with these records ensures easy access and helps you avoid potential penalties while staying within ATF guidelines. If you're looking for extra support, services like TrustNFA can help you create and manage legally compliant NFA trusts tailored to meet regulatory standards.

What are the best tools or services for managing NFA trust documentation and ensuring ATF compliance?

For managing NFA trust documentation while staying in line with ATF regulations, TrustNFA stands out as a solid option. It offers attorney-drafted NFA trust documents and an easy-to-use platform to create legally valid trusts accepted across all 50 states. Key features include lifetime free revisions, secure digital storage, and ongoing compliance support.

Choosing a dependable service like TrustNFA streamlines the entire process, helping you meet legal requirements with less hassle and more convenience.