When to Notify ATF About NFA Trust Changes

When to Notify ATF About NFA Trust Changes

If you manage an NFA trust, knowing when to notify the ATF about changes is critical to staying compliant with federal regulations. Here’s what you need to know:

- No Immediate Notification for Most Changes: You generally don’t need to inform the ATF about trust amendments or restatements unless you're applying for a new tax stamp.

- Notify During Pending Applications: If you modify your trust while a tax stamp application is under review, you must notify your assigned ATF examiner immediately.

- Address Changes: If you move, you must inform the ATF about the new storage location for your NFA items. File ATF Form 5320.20 before moving for certain items (e.g., SBRs) or after moving for others (e.g., silencers).

- Adding Trustees or Beneficiaries: Amendments to include new trustees don’t require immediate notification but must be updated with your next tax stamp application.

Key Tip: Avoid making changes to your trust during active tax stamp applications to prevent complications. Keep all trust documents organized and up to date to ensure compliance.

For detailed guidance on compliance, tax stamp applications, and trust updates, continue reading below.

Gun Trusts - Everything you need to know in 6 minutes

When You Must Notify the ATF

Knowing when to notify the ATF about changes to your gun trust depends on whether you have pending applications or are making updates that affect new tax stamp applications. While the general rule is that you don’t need to notify the ATF about amendments or restatements to your trust until applying for a new tax stamp, there are two specific situations where immediate notification is required.

Keeping your trust documents up to date is crucial to ensure compliance with the National Firearms Act (NFA).

Changes During Pending Tax Stamp Applications

If you make changes to your NFA trust while a tax stamp application is still under review, you must notify the ATF right away. This involves contacting your assigned examiner and providing the updated amendment that reflects the changes. To minimize complications, it’s best to wait until all pending tax stamp applications are approved before making any changes to your trust. Ignoring this requirement can have serious consequences, as violations of the NFA can result in fines of up to $250,000 per firearm.

Changes That Require New Tax Stamp Applications

When applying for a new tax stamp after making updates to your trust, you’ll need to include an updated copy of your restated gun trust. This ensures the ATF has the latest version of your trust documents on file.

Address changes are another critical update. If you move, the ATF must be informed about the new permanent storage location for your NFA items. The process varies depending on the type of move:

- For intrastate moves and interstate moves involving silencers only, you can file ATF Form 5320.20 after moving.

- For interstate moves involving other NFA items, you must file the form before moving and wait for approval.

Staying proactive with these updates helps avoid compliance issues and ensures smooth processing of your applications.

Types of NFA Trust Changes and Required Documents

This section dives into the specific documents you need to submit for different modifications to your NFA trust. Whether you're updating an address, changing trustees, or restating your trust, staying compliant with ATF regulations is critical.

Address Changes

If you’ve moved to a new permanent address, you’ll need to update your trust with a Change of Address amendment and complete ATF Form 20. For moves within the same state or interstate moves involving only silencers, you can file the form after relocating. However, for other NFA firearms, you must file before moving and wait for approval.

When completing ATF Form 20, make sure to select the "permanent move" option. You can submit the form by fax to the NFA Branch at 304-616-4501 or email it to NFAFax@atf.gov. The ATF requires this information to ensure they have the correct permanent storage address for your NFA items.

Adding or Removing Trustees and Beneficiaries

Any changes to trustees or beneficiaries in your trust require a formal amendment to the NFA trust document. This amendment replaces the original provisions, and it must be signed and notarized. It’s also essential to notify all current parties involved in the trust.

When adding a trustee, ensure they are legally eligible to possess firearms by conducting a background check. Under current ATF rules, new co-trustees added through an amendment don’t need to immediately submit fingerprint cards, passport photos, or ATF Form 5320.23. These documents will be required only when the trust applies for a new tax stamp.

Keep all amendments with your original NFA trust documents to maintain accuracy. To avoid confusion, discard outdated amendments, as multiple versions can lead to conflicts. Many NFA attorneys provide an Instructions and Forms packet, which includes templates for amendments you may need in the future.

Trust Restatements

A trust restatement is a comprehensive update to your NFA trust that retains the trust's original name. This approach avoids the hassle of firearm transfers and the need for additional tax stamps. Restatements are particularly useful for aligning your trust with current ATF regulations, such as ATF 41F, while also removing unnecessary disclosure pages to protect sensitive information.

Restatements often include amendments, allowing you to adjust co-trustees, beneficiaries, and property held within the trust. Typically, an attorney handles the process, revising the trust’s provisions but keeping the original trust name intact. This ensures that all firearms purchased under the original trust remain part of the trust.

If you’re considering a restatement, confirm that the updated trust allows for future amendments, giving you the flexibility to adapt as circumstances change. Additionally, removing unnecessary disclosure pages - like "Schedule A" - can help safeguard your trust’s details from third parties.

For those seeking efficient trust management, TrustNFA provides attorney-drafted NFA trust documents with lifetime free revisions and secure digital storage. This service simplifies compliance with ATF regulations as your needs evolve.

ATF Rule 41F and Responsible Persons

On July 13, 2016, ATF Rule 41F went into effect, altering how NFA trusts function. This rule ensures that identification and background check requirements are applied equally to individuals, trusts, and legal entities when applying to make or receive NFA firearms. These changes aim to maintain compliance even when trusts undergo modifications, laying out clear guidelines for the roles and responsibilities of those involved.

"ensure that the identification and background check requirements apply equally to individuals, trusts, and legal entities who apply to make or receive NFA firearms." – ATF

The rule was introduced following a petition by the National Firearms Act Trade & Collectors Association to address gaps in the earlier regulatory framework.

Who Qualifies as a Responsible Person

Under Rule 41F, a "responsible person" is anyone with the authority to manage or direct the policies of a trust concerning firearms. This includes individuals like settlors, trustees, or beneficiaries who have decision-making power within the trust.

Background Check and Documentation Requirements

Every responsible person tied to a new tax stamp application must submit Form 5320.23, a recent photograph, and two FD-258 fingerprint cards. These documents are required to initiate the necessary background check.

The 24-Month Documentation Rule

Rule 41F allows trusts to certify that their details have remained unchanged for up to 24 months. However, for each new tax stamp application, all responsible persons must still submit Form 5320.23, along with updated photographs and fingerprint cards.

Chief Law Enforcement Officer Notification

The rule also eliminated the previous requirement for Chief Law Enforcement Officer (CLEO) certification, replacing it with a notification process. Applicants must send their application and completed Form 5320.23 to the CLEO in the jurisdiction of the responsible person’s residence. This change highlights the importance of keeping address records accurate for all responsible persons.

Impact on Trust Changes

If new responsible persons are added to a trust through amendments, they are not required to submit documentation immediately. However, they must comply with Form 5320.23 requirements during the next tax stamp application. For instance, if a co-trustee is added through an amendment, they won't need to file paperwork right away. Instead, they will provide the necessary form, fingerprints, and photograph with the next application.

sbb-itb-6d07923

How to Maintain NFA Trust Compliance

Keeping your NFA trust compliant requires staying organized and proactive. Properly maintaining your trust documentation ensures you're prepared for ATF inspections or interactions with law enforcement. A well-organized system can help prevent compliance issues, even if your trust is legally sound. Here’s how to stay on top of it.

Storing and Organizing Trust Documents

Keep the original trust documents in a secure place, such as a safe or a locked filing cabinet. Make sure to store all amendments alongside the original trust so that any changes made over time are easy to follow. A dedicated filing system is a great way to keep everything together. Include your original NFA trust, amendments, tax stamps, and ATF correspondence in this system. Using a binder can help during inspections, as it keeps everything neatly organized.

It's also a good idea to maintain both physical and digital copies of your trust documents. Digital backups ensure you’re prepared for standard ATF inspections or emergencies. Create and regularly update a "Schedule A" or assignments page listing all Title I and Title II firearms in the trust. Pre-filling ATF Form 5320.5 (Form 5) for each NFA item can simplify future processes.

Keep all tax stamps and approved forms with your trust records. If you sell an item - especially in private sales - retain documentation proving the sale. For FFLs, Form 3s should be organized by supplier and approval date, and retained for the life of the business.

Using TrustNFA for Updates and Storage

TrustNFA offers a streamlined way to manage and update your NFA trust documents. They provide lifetime encrypted digital storage and unlimited revisions, making it easy to access and update your trust. With 256-bit AES encryption, your documents are secure, and you can download PDFs for offline access.

"Your NFA trust documents are critical legal papers that you'll need to access throughout the lifetime of your trust. From applying for tax stamps to adding new NFA items or making changes to your trust, having immediate access to your documents is essential." – TrustNFA

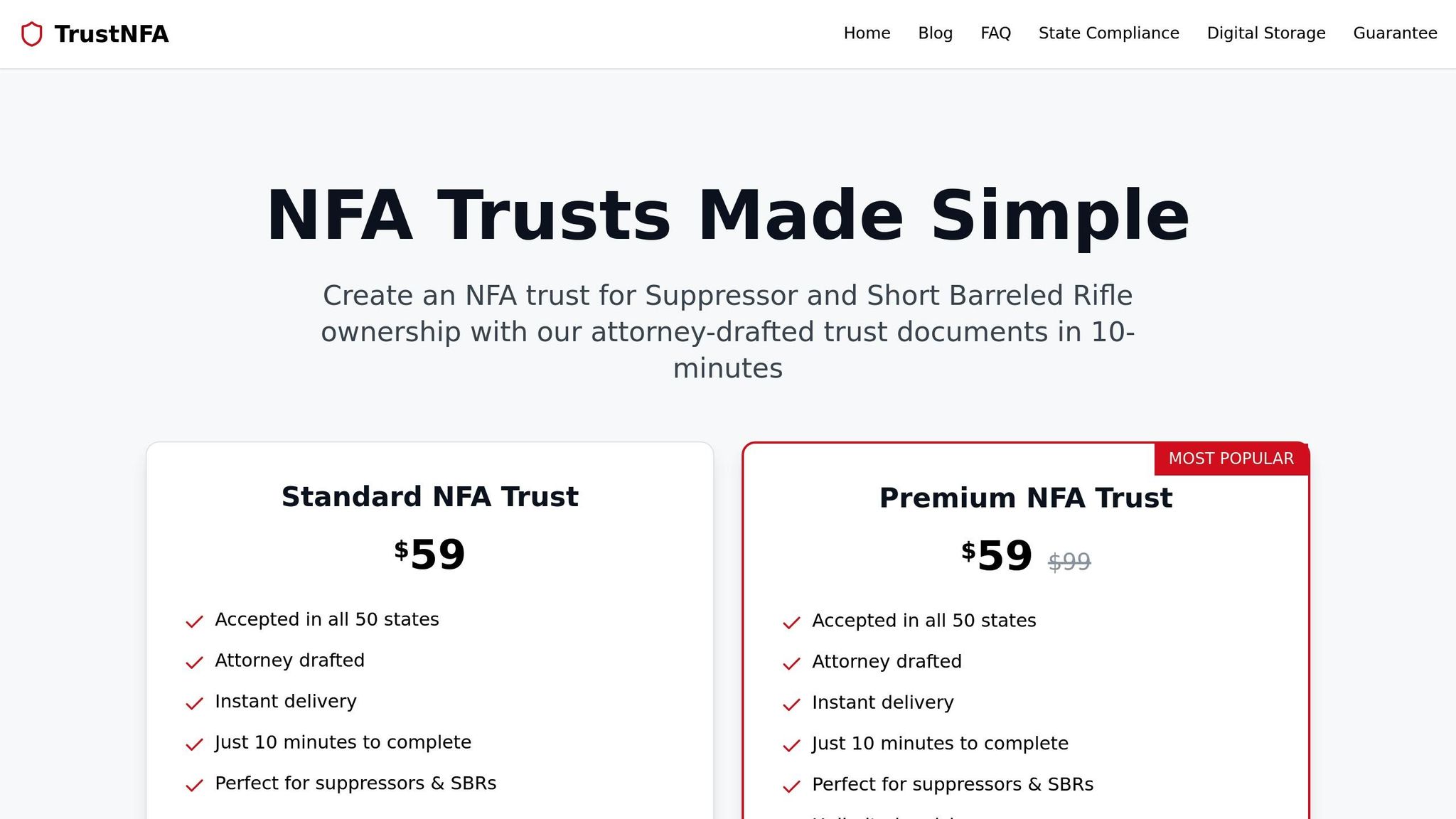

TrustNFA ensures you always have access to both current and previous versions of your trust documents. Their service includes lifetime digital storage at no extra cost with any NFA trust purchase, whether you choose the Standard NFA Trust or the Premium NFA Trust, both priced at $59.

Make it a habit to update your NFA trust regularly, especially when adding or removing trustees or beneficiaries. Use TrustNFA’s secure digital storage for all NFA-related documents, including tax stamps and receipts, and download copies for offline use. Regular updates and quarterly reviews will keep your trust documentation accurate and inspection-ready.

Regular Compliance Reviews

Quarterly compliance reviews are essential for maintaining accuracy and catching potential issues early. Review all trust records at least every three months and conduct physical inventories of your NFA firearms. Compare your inventory with ATF records by requesting a list of items registered to your trust.

Collaborate with legal professionals to ensure your documentation stays current. Review your trust annually with your attorney and make updates promptly when there are changes to trustees or beneficiaries. These practices not only ensure compliance but also make future tax stamp applications smoother and more efficient.

Conclusion: Staying Compliant and Protecting Your NFA Trust

Knowing when to inform the ATF about changes to your NFA trust is essential for staying on the right side of the law. If you're in the middle of a tax stamp application, notify the ATF about any changes. Otherwise, updates made outside of an active application period don’t require immediate notification.

Here’s a key takeaway: it's best to hold off on modifying your trust until all pending tax stamp applications are approved. However, if changes can't wait during an active application, reach out to your assigned examiner right away.

Mismanaging your NFA trust - even accidentally - can result in legal trouble, whether from paperwork mistakes or mishandling.

Keeping accurate and organized records is the cornerstone of protecting your trust. Make sure to maintain detailed records of all firearms, trustees, and any amendments to the trust. This ensures compliance and avoids potential issues during an ATF audit or review.

FAQs

What happens if I don’t notify the ATF about changes to my NFA trust during a tax stamp application?

Failing to inform the ATF about updates to your NFA trust while your tax stamp application is being processed can cause significant problems. The ATF relies on accurate and current information to handle your application effectively. If there are unreported changes, it could lead to delays - or worse, a denial of your application.

Even more serious, an unreported change that invalidates your trust might result in unlawful possession of NFA-regulated items. This could expose you to legal penalties. To steer clear of these complications, ensure you promptly report any changes or amendments to your trust throughout the application process.

What are the responsibilities of trustees and beneficiaries in an NFA trust under ATF Rule 41F?

Understanding ATF Rule 41F and NFA Trusts

ATF Rule 41F places specific compliance duties on responsible persons within an NFA trust, including trustees and co-trustees. These individuals must complete background checks, submit fingerprints, and provide photographs whenever they apply to make or transfer firearms regulated under the National Firearms Act (NFA). This rule significantly increases the administrative responsibilities for trustees, as they need to ensure all federal regulations are followed and manage the trust's firearms accordingly.

On the other hand, beneficiaries of an NFA trust are not classified as responsible persons under Rule 41F. Because of this, they are not required to submit documentation or undergo background checks, even if the trust undergoes changes. This distinction places the compliance burden squarely on trustees, while beneficiaries maintain their rights without facing additional regulatory requirements.

When should I notify the ATF about changes to my NFA trust?

You only need to notify the ATF about changes to your NFA trust if you're applying for a new tax stamp. In that case, make sure to include a copy of the updated trust document with your application. If you're not applying for a new tax stamp, there’s no requirement to inform the ATF about amendments or restatements.

To ensure compliance, keep your trust documents well-organized. This means keeping copies of your trust, any amendments, ATF forms (like Form 1 and Form 4), and background check records for all responsible persons. It’s also a good idea to periodically review your trust to confirm it accurately reflects any updates to trustees or beneficiaries, keeping everything aligned with ATF regulations.

If managing your NFA trust feels overwhelming, services like TrustNFA can make the process easier. They provide attorney-drafted trusts, offer free lifetime revisions, and secure digital storage, so your documents stay compliant and easy to access.